Gas‑Like Particle Collisions and Brownian Motion

- Chaitanya Singh

- Jul 25, 2025

- 2 min read

In this demonstration we model many small particles bouncing and colliding inside a square box, alongside a single larger, heavier particle. As the small particles incessantly ricochet off walls and each other, they transfer momentum to the larger one, producing a gentle random walk. This behavior is a classic illustration of Brownian motion, which has deep connections not only in physics but also in finance.

How the Simulation Works

We define two sets of particles: thousands of tiny ones that move quickly and a single larger particle that moves more slowly but carries most of the mass.

Each particle travels in straight lines until it either hits a wall or collides with another particle. When it hits a wall, its velocity component perpendicular to that wall reverses.

When two particles collide, we calculate the normal and tangential components of their velocities and swap or adjust them according to conservation of momentum and energy. This leads to perfectly elastic collisions where kinetic energy is conserved.

As the small particles bombard the heavy one from all sides, the heavy particle undergoes a jittery, random motion. If you track its position over time, you’ll see it wander without any clear direction.

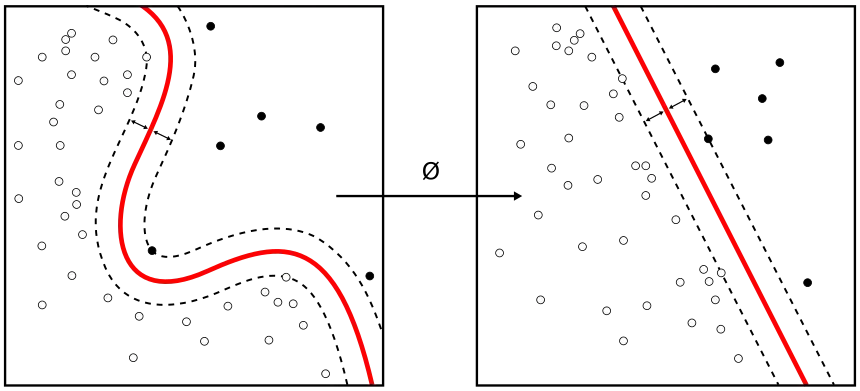

Brownian Motion in a Gas and in MarketsThe random jitter of the heavy particle mirrors what Robert Brown observed in pollen grains floating in water back in 1827. Every grain experienced countless tiny kicks from water molecules, itself invisible to the eye, but whose collective effect gave rise to erratic, continuous motion. Einstein later explained this motion by connecting it to molecular collisions and diffusion coefficients, laying the groundwork for the modern theory of stochastic processes.

In the world of finance, stock prices behave in a remarkably similar way. Every public company share is constantly “kicked” by new pieces of information—earnings reports, economic data, geopolitical events and the actions of buyers and sellers on trading floors and electronic exchanges. Just as each water molecule’s collision is unpredictable, so too is each trader’s decision. When you plot the price of a stock over time, you see a jagged line that, over short intervals, is essentially a random walk. This model underlies the famous Black‑Scholes formula and countless risk‑management techniques used on Wall Street.

Key Takeaways• Particle collisions in a confined box provide a clear, visual example of how microscopic randomness builds up to macroscopic diffusion.• Brownian motion explains both physical phenomena—like pollen grains in water—and mathematical models of stock price fluctuations.• In both physics and finance, systems driven by many small, random inputs tend to evolve unpredictably in the short term but follow well‑defined statistical laws over longer periods.

If you watch the simulation run, focus on the trajectory of the heavy particle. Its path is not smooth or straight but filled with tiny kinks and turns at every collision. Zooming out, however, you’ll notice that it slowly drifts around the center of the box in a manner completely analogous to the price chart of a liquid‑traded stock: erratic on the small scale, yet often predictable in terms of average volatility and diffusion over days or weeks

Comments